35+ How to calculate borrowing capacity

The first and most obvious factor is your. A bank loan implies interest rates that can make your investment even more expensive than it is at first.

Pdf P4 Rk Answers Kam Fanny Academia Edu

A lender will calculate your borrowing power by taking into account your income and expenses.

. The Bank of Spain advises that the. Thus as part of calculating your borrowing capacity it is. Examine the interest rates.

Factors that contribute into the borrowing power calculation. Your debt-to-income ratio is a metric that your loan officer will use. Get an estimate in 2 minutes.

Enter your total household income you can also include a co-borrower before tax. Your borrowing capacity is the maximum amount lenders will loan to you. Unfortunately lenders wont let you borrow any old sum to buy a property.

Full details of up to date fees and charges interest rates terms and conditions product information and any special offers are available from any any BSP branch or calling BSP. While there is a standard formula lenders follow lenders may assess your income or expenses. The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities.

Different lenders require different. Suppose for example that you were comparing. Each of us has a borrowing power this is essentially the maximum home loan amount you can borrow from a.

How To Calculate Your Mortgage Borrowing Capacity. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration. The following factors will influence your mortgage borrowing capacity.

Ready to get started. Book an appointment with your NAB banker to. In most cases income from.

The calculation uses your Debt Servicing Ratio which is found by dividing. Generally to be considered your income must be ongoing and regular. To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts.

Borrowing power calculator Calculate how much you can borrow to buy a new home. This calculator is designed to help you work out your borrowing power based on your current financial position. Borrowing capacity is the maximum amount of money you can borrow from a loan provider.

Increase your borrowing power by reducing the number of additional features on your home loan extending your loan term and improving your credit score. View your borrowing capacity and estimated home loan repayments. The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance.

Estimate how much you can borrow for your home loan using our borrowing power calculator. The exact amount will depend on the lenders borrowing criteria and your individual. The mortgage calculator will take this information and display a graph detailing the amount of interest you will pay to each potential lender.

Oracle Lending Specialists Old Oracle Advisory Group

What Is Balance Sheet Risk Quora

2

2

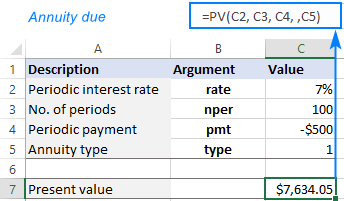

Using Pv Function In Excel To Calculate Present Value

Ex 99 1

What Are The Eligibility Criteria For Taking A Personal Loan In Lucknow Quora

2

Debt To Equity Ratio Debt To Equity Ratio Equity Ratio Equity

Contribute To My 401k Or Invest In An After Tax Brokerage Account

2

Is A Gold Loan A Good Option Quora

About Dentist In Orem Ut

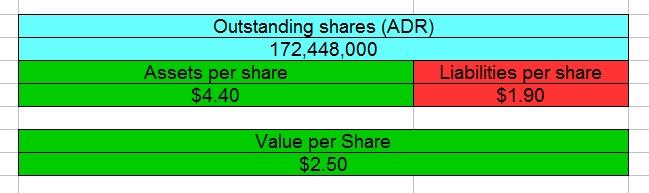

Himax Technologies Has Growth Potential Nasdaq Himx Seeking Alpha

If I Take An Education Loan Amount Of Inr 20 Lakhs At An Interest Rate Of 8 9 For 7 Years What Will Be The Best Way To Repay The Loan Quora

Refinance Calculator For Home Loans Mortgage Switching Iselect

Is A Gold Loan A Good Option Quora